how much taxes are taken out of a paycheck in ky

If its higher 36 percent you should think about. Yes Kentucky residents pay a flat rate for personal income tax.

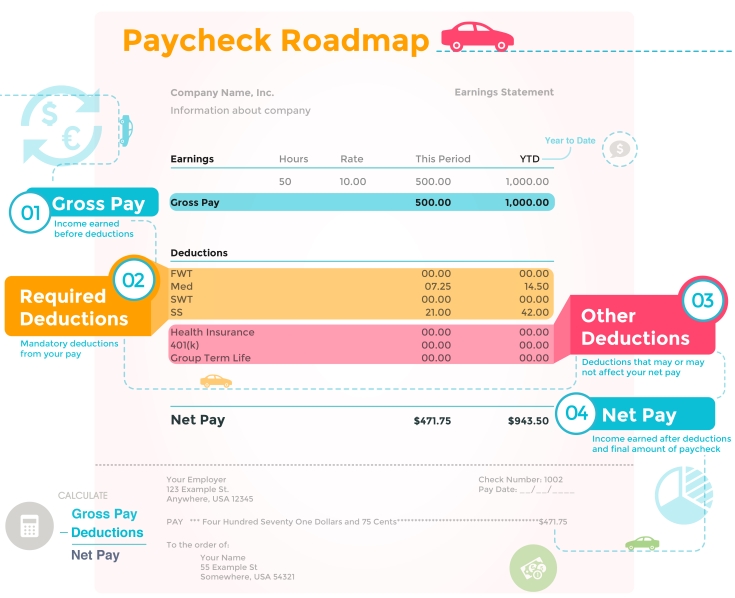

Understanding Your Paycheck Cornerstone Investment Group

The tax rate is the same no matter what filing status you use.

. Employers also have to pay a matching 62 tax up to the wage. No state payroll tax. The state of Kentucky uses a graduated income tax schedule much the same way the federal government does.

The income tax brackets in the state of Kentucky are. For example in the tax year 2020. Supports hourly salary income and multiple pay frequencies.

Most goods and many services are. You are able to use our Kentucky State Tax Calculator to calculate your total tax costs in the tax year 202223. Self-employed individuals have to pay the full 29 in Medicare taxes and 124 in Social Security taxes themselves as there is no separate employer to contribute the other half.

Take Home Pay for 2022. How much tax is taken out of a 200 paycheck in Kentucky please let me know thanks. The Kentucky Income Tax Rate Is 5 Learn How Much You Will Pay On Your Earnings Also keep an eye out for online announcements and mailers with bonus offers.

Has state-level standard deduction. Payroll taxes have flat rates and are sent directly to the program for which they are intended eg Medicare Social Security etc. If you make 55000 a year living in the region of New York USA you will be taxed 11959.

Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. Workers at the lowest end of the economic scale pay a lesser percentage of. 6 rows the income tax is a flat rate of 5.

That means that the states sales tax rate of 6 is the only sales tax youll pay in Kentucky regardless of what city youre shopping in. Social Security tax which is 62 of each employees taxable wages up until they reach 147000 for the year. Effective May 5 2020 Kentuckys tax law requires employers filing on a twice monthly and monthly frequency to electronically file and pay the income tax withheld for.

That means that your net pay will be 43041 per year or 3587 per month. Aside from state and federal taxes many Kentucky residents are. The Kentucky paycheck calculator will calculate the amount of taxes taken out of your paycheck.

Kentucky imposes a flat income tax of 5. Our calculator has recently been updated to include both the latest Federal Tax. Just enter the wages tax withholdings and other information.

Use ADPs Kentucky Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. This free easy to use payroll calculator will calculate your take home pay. Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Kentucky.

![]()

Kentucky Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Why Do I Owe Taxes O Bryan Law Offices Of Kentucky Indiana

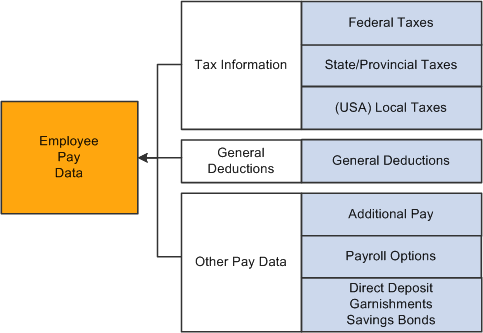

Peoplesoft Payroll For North America 9 1 Peoplebook

Peoplesoft Payroll For North America 9 1 Peoplebook

Kentucky Hourly Paycheck Calculator Paycheckcity

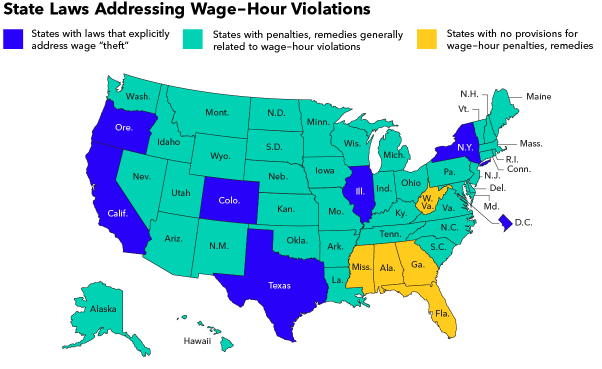

Us States Where The Most Taxes Are Taken Out Of Every Paycheck

Payroll Tax Calculator For Employers Gusto

How To Do Payroll In Kentucky What Employers Need To Know

Employee Payroll How To Withhold Additional Federal And State Income Taxes

Computer Payroll Software Ezpaycheck Updated For Kentucky Small Business

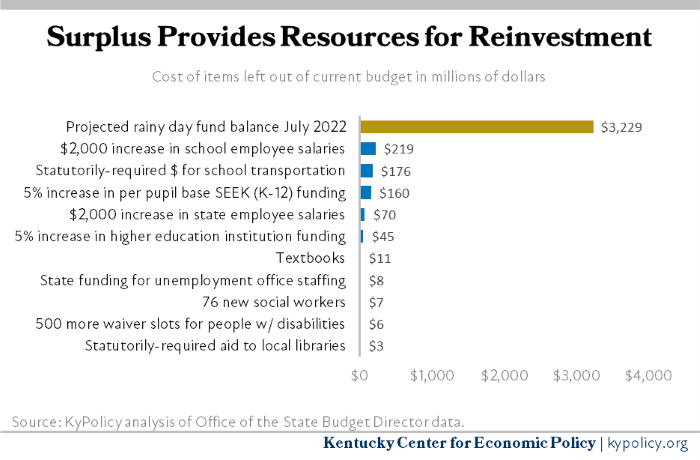

Unprecedented Surplus Presents Opportunity To Both Reinvest In Kentucky S Budget And Build Rainy Day Fund Kentucky Center For Economic Policy

Kentucky Paycheck Calculator Tax Year 2022

Kentucky Paycheck Calculator Smartasset

Midyear Brings Federal State Changes For Payroll Professionals

State Individual Income Tax Rates And Brackets Tax Foundation

Payroll Tax Administration Peo Professional Employer Organization Erigo

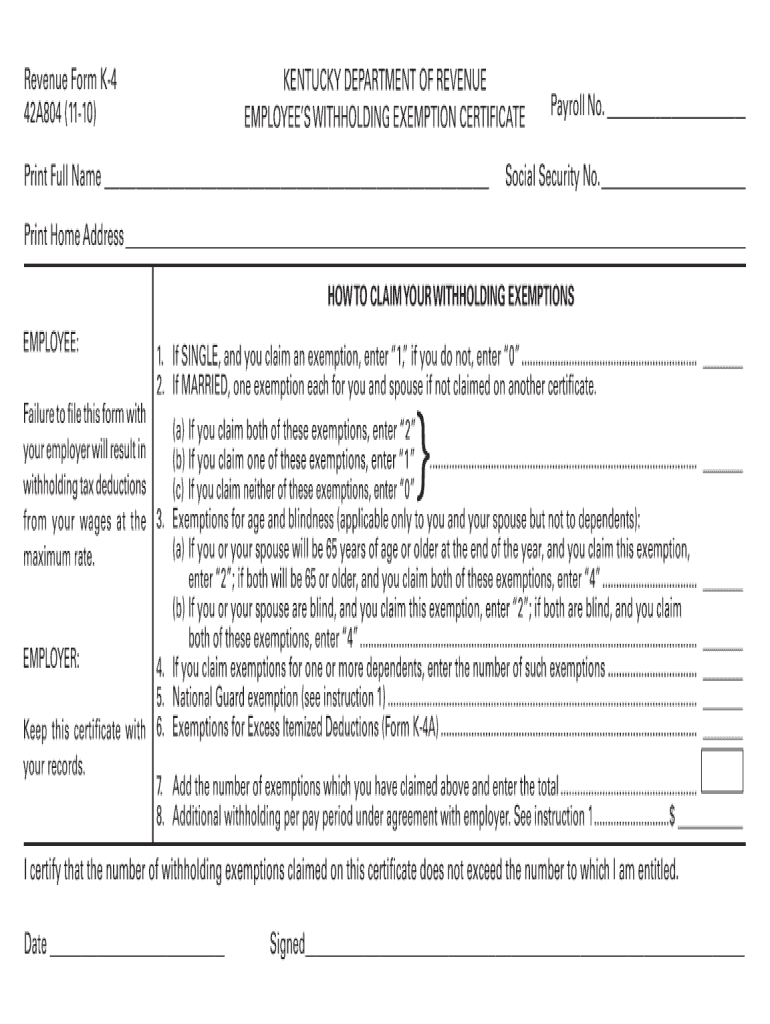

Ky Dor 42a804 Form K 4 2010 Fill Out Tax Template Online Us Legal Forms

Here S How Much Money You Take Home From A 75 000 Salary

Kentucky Paycheck Calculator 2022 With Income Tax Brackets Investomatica